Professors' Insights﹀

Capital Flight and the Role of the IMF and the World Bank in Stabilizing the World Economy

2022-12-12

By Justin Yifu Lin and Yan Wang

The global economy is facing three overlapping crises: the climate crisis, as shown by extreme weather disasters, Russia’s war in Ukraine, which has caused energy and food prices to skyrocket, and capital flight from emerging markets and developing countries, which refers to the rapid outflow of US dollar reserves from a country and which has exacerbated sovereign debt distress in some of these countries.

Since March 2022, there has been a second round of large capital flight from emerging markets and developing countries, leading to declines in their foreign exchange (FOREX) reserves, local currency depreciation and difficulties to repay dollar denominated loans.

During the International Monetary Fund (IMF) and World Bank Annual Meetings in October this year, many Global South countries voiced their concerns over capital flight and its severe consequences, pointing to the misleading policies pushed by the multilateral development banks (MDBs) and the IMF since the 1990s for capital account liberalization, and asking the MDBs and the IMF to do more.

A recent book by Leonce Ndikumana and James K. Boyce found that between 1970-2018, the African continent lost $2 trillion to capital flight. The authors tracked the sources, the channels and destinations of capital flight, revealing that the overall picture is complex, but not unrelated to the premature capital account liberalization and the weak global governance system around tracking the flows of trade mis-invoicing, money laundering, tax evasion and illicit financial transactions, which African countries frequently struggle to track.

Given this situation, policymakers and development practitioners must ask tough questions. First, what was the theoretical basis for the neoliberal policies to promote capital account liberalization? Who should be held accountable for the consequences of these misleading policies?

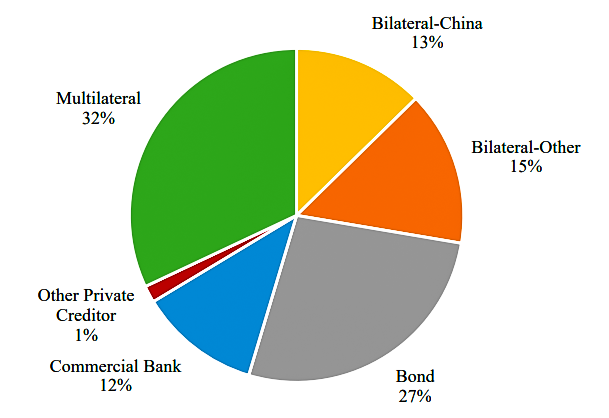

Second, when we examine the issues of mounting debt in Africa, using the World Bank International Debt Statistics (IDS) data, we found that the MDBs are the largest creditors of African countries, accounting for 32 percent of all public and publicly guaranteed (PPG) external debt. Bondholders accounted for 27 percent, and bilateral creditors accounted for 28 percent, less than half of which came from China (13 percent), as shown in Figure 1. The question is, what is the rationale for the World Bank (specifically the International Bank for Reconstruction and Development, or IBRD) to stay out of the current round of debt relief?

Figure 1: Decomposition of External Debt in Africa, by Creditor Type

Washington-based Bretton Woods Institutions, namely the IMF and the World Bank, have the responsibility and ability to inject liquidity at times of foreign exchange and financial crisis, and they can do so at low budgetary costs. However, though they have the ability, the will to do so has been lacking.

Charles Kenny at the Center for Global Development and others have pointed out that, despite much rhetoric, the world is falling far short in its collective ability to respond to crises. Kenny’s analysis shows that despite today’s ‘polycrisis,’ World Bank lending has not kept up with economic growth since 2017. In fact, it has declined in the fiscal year 2022, and the IMF has not done much better, as shown in Figure 2. This should be unacceptable to the shareholders of the IMF and the World Bank.

Figure 2: The Net Disbursement in the World Bank’s International Development Association (IDA) and the IMF’s Poverty Reduction and Growth Trust (PRGT)

Given this decline in lending during polycrisis in 2022, which is pro-cyclical and counter to shareholders’ expectations, the rationale for the IBRD to stay out of the current debt relief effort has significantly weakened.

What should be done to address the capital flight crisis? In our view, four steps are necessary.

First, the IMF released in a staff paper in 2010 and updated its Institutional View in 2022 to say that its past advice on capital account liberalization was misleading, and at times of crises, countries can legitimately use “capital flow management tools.” So far, few countries have done so, despite the fact that they are suffering massive capital outflows and currency depreciation, exacerbating debt distress in some (though not all) low-income countries. We suggest that countries in debt distress may consider using these capital flow management tools.

Second, we support capital increase and quota reform in the World Bank and the IMF. We support the suggestion by Larry Summers that “the Bank’s shareholders insist on a financial vision that will result in $2 trillion in lending over the 2024-34 decade.” A rapid capital increase is possible, given the Asian Development Bank’s action of utilizing their Asian Development Fund as the ADB’s capital base. The IMF should rapidly increase their unconditional lending to the least developed countries utilizing Special Drawing Rights (SDRs), which were contributed to the new Resilience and Sustainability Trust (RST) facilities by China and other countries. Timely action is essential for fulfilling the expected function of these institutions as “the lender of last resort.”

Third, the World Bank, with its mission of reducing global poverty, should participate in the current round of debt restructuring by taking the lead in innovative approaches, such as debt to “Brady-like” bond swaps, debt-to-nature swaps, debt-to-climate swaps and asset-based refinancing. Emerging and developing countries can then follow their models and learn from their experiences.

Fourth, given the dire needs for debt restructuring and climate financing to address multiple crises, we call for an additional increase of SDR allocation of $800 billion in 2023, and regular increases thereafter. The allocation of the new round of SDRs should be pro-development and pro-green energy investment.

This week, Chinese Premier Li Keqiang in China will meet with the heads of six major international organizations in China, including the Managing Director of the IMF, Kristalina Georgieva, and the President of the World Bank Group, David Malpass. This is an ideal occasion for China to voice its concerns and play a significant coordination role in global governance. Let’s hope there will be positive progress coming out of this meeting.

The blog was posted on the website of the Boston University Global Development Policy (GDP) Center, Thursday, December 8th, 2022.