Research﹀

-

Latest Activities NSE International Conference NSE Symposium/Winter Camp

-

Objectives and Actions Working Groups Database Reports & Publications Governance and Partners Events Policy Briefing

No.3 | Justin Yifu Lin: The Washington Consensus Revisited

2016-11-07

Content introduction:

Journal of Economic Policy Reform,Vol. 18, No. 2(2014), pp.96-113.

The Washington Consensus Revisited: A New Structural Economics Perspective

Justin Yifu Lin

Abstract

The Washington Consensus reform resulted in economic collapse and stagnation in many transition economies and “lost decades” in other developing countries in 1980s and 1990s. The paper provides a new structural economics perspective of such failures. The Washington Consensus reform failed to recognize that many firms in a transition economy were not viable in an open, competitive market because those industries went against the comparative advantages determined by the economy’s endowment structure. Their survival relied on the government’s protections and subsidies through various interventions and distortions. The Washington Consensus advised the government to focus their reforms on issues related to property rights, corporate governance, government interventions and other issues that may obstruct a firm’s normal management.Without resolving the firms’ viability problem, such reforms led to the firms’ collapse and an unintended decline and stagnation of the economy in the transition process. This paper suggests that the viability assumption in neoclassical economics be relaxed when analyzing development and transition issues in socialist, transition and developing economies.

JEL Classification: L5, O1, P5

- I. Introduction

-

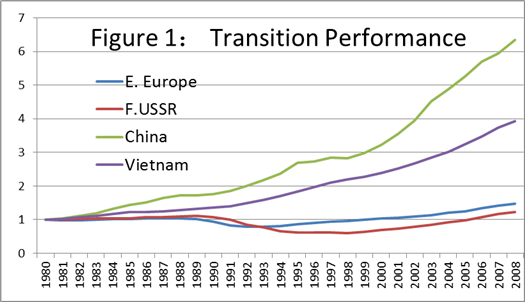

Since the late 1970s, China and other socialist countries began the transition from a planned economy to a market economy in order to improve their economic performance. Figure 1 shows that such a transition brought about rapid economic growth in China and Vietnam from the very beginning. The transitions that began in the early 1990s in the former Soviet Union and Eastern European countries (FSUEE hereafter), however, led to dramatic declines in their economies and deterioration in most aspects of social development (World Bank, 2002; Dell’Anno and Villa, 2013).A survey conducted in 2006 by the European Bank for Reconstruction and Development and the World Bank of 29,000 people in 29 countries—including Eastern and Southeastern Europe, the Baltic states, the Commonwealth of Independent States and Mongolia—found that only 30 per cent believed their lives were better than in 1989(EBRD, 2007).According to EBRD’s transition indicators, many transition economies in FSUEE had become “stuck in transition”: Price liberalization, small-scale privatization and the opening-up of trade and foreign exchange markets were mostly complete by the end of the 1990s. However,economic reform had slowed in areas such governance, enterprise restructuring and competition policy, which remained substantially below the standard of other developed market economies (EBRD 2013). During the same period, most developing countries in other parts of the world followed the advice of the International Monetary Fund (IMF) and the World Bank to implement reforms to reduce government intervention and enhance the role of the market. The result was, however, also disappointing. The economic performance of most developing countries deteriorated during this period (Barro, 1998). Easterly (2001) referred the 1980s and 1990s as the lost decades for the developing countries.

Such a contrasting transition results in East Asia and in Eastern Europe and Former Soviet Union are unexpected by economists.Economic profession is known to have diverse views on practically all issues, however, as Summers (1994, p. 252-3) wrote, when it comes to reforming a socialist economy, there is a surprising consensus among mainstream economists for adopting shock therapy based on the Washington Consensus.[1] Washington Consensus was a term coined by Williamson (1989), originally referring to a policy package recommended to crisis-hit Latin American countries.[2] The main idea of the Washington Consensus was to eliminate government interventions and distortions so as to create a private property-based efficient, open, competitive market economy. The shock therapy that was promoted to Eastern Europe and the former Soviet Union for their transition to a market economy was a version of the Washington Consensus.

One element of the shock therapy is the need for rapid privatisation. Arguments in support of this are as follows: private ownership is the foundation for a well-functioning market system; real market competition requires a real private sector (Sachs and Lipton, 1990); most problems encountered by state-owned enterprises(SOEs)in a transitional economy can be ameliorated by rapid privatisation (Sachs, 1992); and privatisation must take place before SOE scan be restructured (Blanchard et al., 1991).[3]Another early consensus view for transition is the need for a total big-bang price liberalisation. An influential article by Murphy et al. (1992) attributed the fall in outputs in the Soviet Union in 1990–91 to partial price liberalisation. They argued that a dual-track pricing system encouraged arbitrage, corruption, rent seeking and diversion of scarce inputs from high-value to low-value use. The last element in shock therapy is the need to tighten a government’s fiscal discipline to maintain macroeconomic stability so that prices can serve as a guide for resource allocation and market mechanism can work well.

China was one of the first among the socialist countries to transit from a planned economy to a market economy.In the 12 years from 1978 to 1990,the transition inChina generated remarkable achievements, with the country’s GDP growing 9.0% annually and its trade volume growing at 15.4% per year. During this period, urban per capita income grew 5.9% annually, while that of rural areas grew at a spectacular rate of 9.9% annually (NBS, 2002 pp.17, 94,148). Living standards in China increased significantly and disparities between urban and rural areas decreased. However, China did not adopt the shock therapy, instead it adopted a gradual approach in its transition. It’s SOEs were not privatized; a dual-track resource allocation system was prevalent with state planning still playing a very important role alongside markets in resource allocation. Many economists at that time thought that although China’s economic transition was blessed with beneficial initial conditions,[4] the dual-track system would soon lead to efficiency loss, rent-seeking, and institutionalized state-opportunism (Balcerowicz, 1994; Woo, 1993; Sachs and Woo, 1994 and2000; Qian and Xu, 1993.). Some economists even claimed that, despite its initial success, China’s dual-track approach to the economic transition would eventually lead the economy to a disastrous collapse (Murphy, Schleifer, and Vishny, 1992; Sachs, Woo, and Yang, 2000).[5] Instead of collapse, Chinese economy not only withstood the shocks and contributed to the quick recoveries of East Asian financial crisis in the late 1990s and the recent global financial crisis but also accelerated its average GDP growth rate from 9.0% annually in 1979-1990 to 10.3% in 1991-2012 (NSB 2013, Lin 2012b).

In contrast,most economists in the early 1990s were optimistic about the transition in the FSUEE due to the fact that their transition followed the shock therapy recommended by the mainstream economists(Lipton and Sachs, 1990; Blanchard, Dornbusch, Krugman, Layard, and Summers, 1991; Boycko, Shleifer, and Vishiny, 1995). Economists recommending shock therapy also knew the transition from one economic system to another took time and that it was costly to cast aside vested interests. Nevertheless they optimistically predicted that the economies would grow after six months or a year following an initial downturn resulting from implementation of the shock therapy (Brada and King, 1991; Kornai, 1990; Lipton and Sachs, 1990; Wiles, 1995). According to their arguments, the FSUEE would soon outperform China, even though the former had instituted their reforms much later.Nevertheless, such prediction has never been realized.[6]

In the ten years after the transition started, the countries that implemented shock therapy experienced serious inflation and economic decline. Russia’s inflation rate reached 163% per year, while Ukraine’s reached 244% per year in 1991-2000. The cumulative output decline in countries in Central and Southeastern Europe and the Baltics reached 22.6%; in countries of the Commonwealth of Independent States output fell 50.5%. In 2000, Russia’s GDP was only 64 % of what it had been in 1990, while in Poland, the best performing economy in the FSUEE, GDP increased only 44%, compared with 1990.[7] Meanwhile, the Gini coefficient of income per capita, a measurement of income disparity, increased from 0.23 in 1987-90 to 0.33 in 1996-98 in countries of Central and Southeastern Europe and the Baltics, and from 0.28 to 0.46 in countries of the Commonwealth of Independent States (World Bank 2002).Overall, as summarized by Campos and Coricelli (2002),the countries that implemented shock therapy experienced great difficulties in their reforms,demonstrated in the seven stylized facts: output fell, capital shrank, labor moved, trade reoriented, structure changed, institutions collapsed and transition costs.[8].

Why then were most economists not optimistic about China’s future performance in the early 1990s in spite of its impressive performance of its first 10 years of transition? Many economists, who participated in the FSUEE reforms, work at the frontiers of economic research and are considered masters of modern economics. Why couldn’t they predict and explain the difficulties brought about by shock therapybased on the Washington Consensus, and why, at the same time, were they pessimistic about China’s approach to transition? A rethinking of the existing economic transition theories is in order.In this paper I will provide a new structural economics analysis of the reasons for the inadequacy of using Washington Consensus as a policy framework for economic transition.This paper is organized as follows: Part I Iintroduce the main ideas of the new structural economics; part II Idefines the concept of viability and points out that most firms in transition economies in fact were nonviable due to their governments’ adoption of comparative advantage-defying development strategies before the transition and the government’s interventions and distortions were endogenous to the needs of protect and subsidize the nonviable firms. Part IV explains why the Washington Consensus reforms led to sever economic difficulties and China’s dual-track gradual approach to transition achieved stability and dynamic growth in the transition process.Part V concludes with a suggestion for incorporating the viability concept in the neoclassical analysis.

- II. The New Structural Economics

-

The new structural economics is an application of neoclassical approach to study the determinants of economic structure and causes of its transformation over time in the process of economic development and transition in a country(Lin, 2011, 2012a).[9] It starts with the observation that the nature of modern economic development is a process of continuous structural change in technologies, industries and hard and soft infrastructure, which makes possible the continuous increase in labor productivity and thus per capita income in an economy. The optimal industrial structure in an economy at a specific time, that is, the industrial structure that makes the economy most competitive domestically and internationally at that specific time, is endogenous to its comparative advantage, which in turn is determined by the economy’s given endowment structure at that time.[10] Economies that try to grow simply by adding more and more physical capital or labor to the existing industries eventually run into diminishing returns; and economies that try to deviate from their comparative advantage in their industrial upgrading are likely to perform poorly because firms in the new industries will be nonviable in an open, competitive market and their survival require their governments’ subsidies and protections, often through various distortions and interventions in the market (Lin 2009).

Because the optimal industrial structure at any given time is endogenous to the existing factor endowments, a country trying to move up the ladder of technological development must first change its endowment structure. With capital accumulation, the economy’s factor endowment structure evolves, pushing its industrial structure to deviate from the optimal determined by its previous level. Firms then need to upgrade their industries and technologies accordingly in order to maintain market competitiveness.

If the economy follows its comparative advantage in the development of its industries, its industries will have the lowest possible factor costs of production and thus be most competitive in domestic and world markets.[11] As a result, they will gain the largest possible market share and generate potentially the largest surplus. Capital investment will also have the largest possible return. Consequently, households will have the highest savings propensity, resulting in an even faster upgrade of the country’s endowment structure.

A developing country that follows its comparative advantage to develop its industries can also benefit from the advantage of backwardness in the upgrading process and grow faster than advanced countries. Enterprises in developing countries can benefit from the industrial and technological gap with developed countries by acquiring industrial and technological innovations that are consistent with their new comparative advantage through learning and borrowing from developed countries.

The main question then is how to ensure that the economy grows in a manner that is consistent with its comparative advantage determined by its endowment structure. The goal of most firms everywhere is profit maximization, which is,ceteris paribus,a function of relative prices of factor inputs.The criterion they use to select their industries and technology is typically the relative prices of capital, labor and natural resources. Therefore, the precondition for firms to follow the comparative advantage of the economy in their choice of technologies and industries is to have a relative price system which can reflect the relative scarcity of these production factors in the endowment structure. Such a relative price system exists only in a competitive market system. In developing countries where this is usually not the case, it is necessary that government action be taken to improve various market institutions so as to create and protect effective competition in the product and factor markets.

In the process of industrial upgrading,firms need to have information about production technologies and product markets. If information is not freely available, each firm will need to invest resources to collect and analyze it.First movers who attempt to enter new industries can either fail—because they target the wrong industries—or succeed—because the industry is consistent with the country’s new comparative advantage. In case of success, their experience offers valuable and free information to other prospective entrants. They will not have monopoly rent because of competition from new entry. Moreover, these first movers often need to devote resources to train workers on the new business processes and techniques, who may be then hired by competitors. First movers generate demand for new activities and human capital which may not have existed otherwise. Even in situations where they fail, their bad experience also provides useful knowledge to other firms. Yet, they must bear the costs of failure. In other words, the social value of the first movers’ investments is usually much larger than their private value and there is an asymmetry between the first movers’ gain from success and the cost of failure. Successful industrial upgrading in an economy also requires new types of financial, legal, and other “soft” (or intangible) and “hard” (or tangible) infrastructure to facilitate production and market transactions and allow the economy to reach its production possibility frontier. The improvement of the hard and soft infrastructure requires coordination beyond individual firms’ decisions.

Economic development is therefore a dynamic process marked with externalities and requiring coordination. While the market is a necessary basic mechanism for effective resource allocation at each given stage of development, governments must play a proactive,enabling role to facilitate an economy to move from one stage to another. They must intervene to allow markets to function properly. They can do so by(i) providing information about new industries that are consistent with the new comparative advantage determined by change in the economy’s endowment structure; (ii) coordinating investments in related industries and the required improvements in infrastructure; (iii) subsidizing activities with externalities in the process of industrial upgrading and structural change; and (iv) catalyzing the development of new industries by incubation or by attracting foreign direct investment to overcome the deficits in social capital and other intangible constraints.

In sum, the new structural economics framework is three-pronged: it includes are cognition of differences in the optimal industrial structure for countries in different stages of development due to the differences in comparative advantage defined by their endowment structures; reliance on the market as the optimal resource allocation mechanism at any given stage of development; and theacknowledgementof a facilitating roleplayed byan enabling state in the process of industrial upgrading and structural transformation. It helps explain the economic performance of the most successful developing countries.

- III. Viability,Development Strategy and the Endogenous Nature of Distortions in A Transition Economy

-

The key characteristics of the endowment structure in developing countries are a relative abundance of natural resources or unskilled labour and a scarcity of human and physical capital.Based on the new structural economics analysis, developing countries with abundant unskilled labour or resources but scarce human and physical capital will have comparative advantages in the labour-intensive and/or resource-intensive industries in open, competitive markets; and developed countries with abundant capital and relatively scarce labour will have comparative advantages and be competitive in capital-intensive industries.The development strategy in socialist countries and that advocated by the dominant development thinking—the structuralism in the 1950s and 1960s and pursued by governments in many developing countries after WWII advised the governments in socialist and developing countries to develop the capital-intensive industries prevailed in advanced countries (Lin 2011). Such a development strategy in essence was a comparative advantage-defying (CAD) strategy(Lin2003,2009).

Under a CAD strategy, firms in prioritised industries are not viable in an open, competitive market. Even if they are well managed, they cannot earn a socially acceptable profit.[12] Unless the government provides subsidies and/or protection, no one will invest in or continue to operate such firms. The lack of capital-intensive industries in developing countries is not, therefore, due to market rigidity,as the structuralism claimed,but to the non-viability of the firms in an open, competitive market.[13]

In order to implement a CAD strategy,the socialist government and other developing-country’s governments as well had to subsidize numerous nonviable enterprises.Due to limited tax-collection capacities, the governments had to resort to administrative measures—granting the non-viable enterprises in prioritised industries subsidies/protections through monopoly, repressing interest rates,[14] over-valuing domestic currency and lowering raw materials prices. Such interventions inevitably caused widespread shortages in funds, foreign exchanges and raw materials. The government, therefore, needed to allocate these resources directly to these enterprises through administrative channels, including national planning in the socialist countries and credit rationing, investment and entry licensing in non-socialist developing countries.[15]

Although with the above administrative measures, a developing countrycouldbuild up industries thatdefyingthe comparative advantages,serious information problems arose.It was impossiblefor the governmentto determine the necessary amount of protection and subsidies. When an enterprise incurred a loss,—even if it was due to mismanagement or moral-hazard problems—the blame would fall on the government for insufficient protection and subsidies, and the enterprise would use this as an excuse to ask for even more protection and subsidies, causing the soft budget constraint problems (Lin and Tan, 1999)[16] and rent-seeking behaviour (Krueger, 1974).To reduce incentives for rent-seeking, the governments in all socialist countries and many other developing countries nationalized the firms in priority industries (Lin, Cai and Li 2001,Lin and Li 2008).

The CAD strategy might also prevent a developing country to benefit from the advantage of backwardness due to patent protections and embargoes on advanced technology from developed countries. Because the limited available capital resources were used to develop prioritised capital-intensive industries, labour-intensive industries that were consistent with the economy’s comparative advantages could not receive sufficient financial supports and their development was repressed.With an overall poor economic performance, the ability to carry out expensive and risky indigenous technological research and development would be limited. After a few years, these once advanced industries in the priority sector became obsolete. As a result, the technology gap with developed countries soon widened.

A CAD strategy would also affect income distribution. In socialist countries that had eliminated capitalists, the development of prioritised industries could be realised through direct government investment, accompanied by suppression and equalisation of wage rates though administrative measures. The equality was artificial. In other market-based countries income distribution would be polarized (Lin and Chen, 2007; Lin and Liu 2008). In those countries, only wealthy and/or crony capitalists, who had intimate relationships with the government and opportunities to access bank loans and fiscal resources, had the ability to invest in prioritised capital-intensive industries. Since subsidies to prioritised industries had to come from those workers and peasants who were relatively poor and unable to invest in the priority industries through direct or indirect taxations. Therefore, the adoption of a CAD strategy inevitably polarized income distribution. Meanwhile, because the prioritised industries were capital intensive, they generated only limited employment opportunities. The labour-intensive industries that could generate more employment opportunities could not develop fully due to the lack of capital.Large numbers of labourers were either retained in rural areas or became unemployed or semi-employed. As such, the wage rate was repressed. Therefore, even if a fast investment-led growth was achieved at the beginning, the poor would not benefit from the growth (Lal and Myint, 1996).

In summary, while the adoption of a CAD strategy could establish some advanced industries in the socialist and developing countries, it inevitably led to inefficient resource allocation, suppressed working incentives, rampant rent-seeking behaviour, deteriorating income distribution and poor economic performance. In the end, the adoption of a CAD strategy would not narrow the gap between developing and developed countries; instead, the gap would become wider and wider.[17]The poor performance thus called for reforms in the economy and a transition from the government-led, planned economy to a market economy.

Since many existing firms in socialist and transition economies were not viable, it is not surprising that existing neoclassical economic theories, with its implicit viability assumption,is not an adequate for addressing problems in socialist and transition economies. If the problem of non-viability is not eliminated, and if the government is unwilling or unable to let the nonviable firms go bankrupt, eliminating distortions and reforming institutional arrangements according to the existing neoclassical economic theories are likely to turn the arrangements from the second best to the third best. Therefore, the reforms at best will not achieve the intended effects and at worst will exacerbate the situation.

IV. Viability and the Failure of Washington Consensus

Why did the Washington Consensus reforms cause economic decline, stagnation and frequent crises in many transition economies in FSUEE and many other developing countries? What went wrong was not the goal of setting up an open, competitive market system but the failure to recognise the endogenous nature of the distortions in the economic system before transition.

The objectives of the Washington Consensus reforms were to eliminate government distortions and interventions in socialist and developing countries, and to set up a well-functioning market system. If this goal were realised, market competition would determine the relative prices of various products and production factors, and relative prices would reflect their relative scarcities in factor endowments. Given these prices, market competition would induce enterprises to choose industries, products and technology that were consistent with the comparative advantages determined by the economy’s endowment structure. Consequently, the economy would be able to make full utilisation of the advantage of backwardness, and would prosper.

Nevertheless, there existed many non-viable enterprises in transition economies. Without government protection and subsidies, those enterprises were unable to survive in an open and competitive market. If there were only a limited number of such non-viable enterprises, the output value and employment of those enterprises would be limited; shock therapy that eliminated all government interventions at once might be applicable. With the abolition of government protection and subsidies, these non-viable enterprises would become bankrupt. However, the originally suppressed labour-intensive industries would thrive, and newly created employment opportunities in these industries could surpass the losses from the bankruptcy of non-viable firms. As a result, the economy could grow dynamically soon after implementing the shock therapy, with at most a small loss of output and employment initially.

On the other hand, if the number of non-viable firms was large, the output value and employment of those firms would make up a large share of the national economy. Shock therapy might result in economic chaos due to large-scale bankruptcies and dramatic increases in unemployment. In order to avoid such consequences or to sustain these ‘advanced’ non-viable enterprises for national security or pride, the government had no choice but to continue its protection and subsidies for these firms often in a more disguised way than the previous distortions: that is, changing the previous second-best distortions to even worse third- or fourth-best distortions. Even if the firms were privatised, soft budget constraint problems would continue. The subsidies to the non-viable firms could even increase due to the private owners having greater incentives to lobby for subsidies and protection (Lin and Li 2008). In effect, this was what happened in Russia and many other countries in Eastern Europe and the former Soviet Union (Brada, 1996; Frydman et al., 1996; Lavigne, 1995;Pleskovic, 1994;Stark, 1996;Sun, 1997;World Bank, 2002). In the end, the economy could find itself in an awkward situation of shock without therapy (Kolodko, 2000, Galbraith, 2002).[18]

Facing the endogenously formed distortions and the existence of large-scale non-viable enterprises in the economy, the dual-track gradual approach adopted by the Chinese government is arguably better than shock therapy(McKinnon, 1993,Lau, Qian, and Roland 2000).Instead of removing all subsidies immediately proposed by the Washington Consensus, the Chinese government adopted measures to improve incentives for farmers and SOE workers while retaining transition subsidies to SOEs in the priority industries; it adopted the individual household-based farming system to replace the collective farming system,[19] and introduced profit-retention and managerial autonomy toSOEs[20], making farmers and workers partial residual claimants. This reform greatly improved the incentives and productivity in agriculture and industry (Grove et al., 1994; Jefferson et al., 1992; Jefferson and Rawski, 1995; Lin, 1992; Li, 1997; Weitzman and Xu, 1994). Then the government allowed collective township-and-village enterprises (TVEs)[21], private enterprises, joint ventures, and SOEs to use the resources under their control to invest in labour-intensive industries that had been suppressed in the past. Meanwhile, the government required farmers and SOEs to fulfil their obligations to deliver certain quotas of products to the State at pre-set prices. The former reform improved the efficiency of resource allocation and the latter ensured the government’s ability to continue subsidising the non-viable firms. Therefore, economic stability and dynamic growth were achieved simultaneously.

Finally, with the shrinking of the SOEs’ share in the economy along with the dynamic growth path and the reduction in needs of subsidizing the SOEs, the government gradually eliminated price distortions and administrative allocation, and privatised the small and medium-sized SOEs—most of which were in the labour-intensive sectors and were consistent with China’s comparative advantages (Lin2012b;Naughton 1995; Nolan 1995; Qian 2003). Although there was no mass privatisation and the property rights of the collective township and village enterprises were ambiguous, market competition increased and economic performance was improved (Li 1996; Lin, Cai and Li, 1998).

The transitional strategy in Vietnam was similar to that employed in China.Through this cautious and gradual approach, China and Vietnam have been able to replace their traditional Soviet-type systems with a market system while maintaining remarkable records of stability and growth.

Incidentally, Mauritius has since the 1970s also adopted a dual-track approach to open up its CAD strategy-type import-substitution economy. It set up export-processing zones to encourage exports and maintained import restrictions to protect non-viable enterprises in domestic import-competing sectors. This reform strategy saw Mauritian GDP grow at 5.9 per cent per annum between 1973 and 1999—an exceptional success story in Africa (Rodrik, 1999; Subramanian and Roy, 2003).

However,the completion of transition from plan to market through a dual track approach depends on the elimination of viability problem of firms in the traditional sectors(Lin 2012b).In spite of the extraordinary growth, the Chinese economy has encountered a series of problems, including the rising income disparities, over-concentration of income in the corporate sector, the external imbalances, the widespread corruption and others. Many of those problems are consequences of the dual-track reform, which retains certain distortions as a way to provide supports to non-viable firms in the priority industries. Major remaining distortions include the concentration of financial services in the four large state-owned banks, the almost zero royalty on natural resources, and the monopoly of major service industries, including telecommunication, power, and banking.

Those distortions contribute to the stability in China’s transition process. They also contribute to the rising income disparity and other imbalances in the economy. This is because only big companies and rich people have access to credit services provided by the big banks, and the interest rates are artificially repressed. As a result, big companies and rich people are receiving subsidies from the depositors who have no access to banks’ credit services and are relatively poor. The concentration of profits and wealth in large companies and widening of income disparities are unavoidable. The low royalty levies of natural resources and the monopoly in service sector have similar effects. Rich people and large corporations have a low consumption propensity, a concentration of income to them leads to over savings and investments, leading to trade large surpluses. Those distortions create rents, rent-seeking and widespread corruptions.

Therefore, it is imperative for China to address the structural imbalances, by removing the remaining distortions in the finance, natural resources and service sectors so as to complete the transition to a well-functioning market economy.The precondition for such reforms is to eliminate the SOEs’ viability problem.[22]

The viability problem of SOEs can be solved according to four different strategies, depending on the nature of the SOEs’ outputs (Lin, Cai and Li, 1998 and 2001). The first group includes mainly the defense-related SOEs whose production, intensive in both capital and technology, runs against China’s comparative advantages, but their outputs are essential for national security. For this group of SOEs, direct fiscal appropriation is necessary for their survival and the government should directly monitor their production and operations. It is reasonable to expect that there are only a few SOEs in this category. The second group of SOEs also requires intensive capital and technological inputs for their production, but their outputs are not sensitive to national security and they have large domestic markets. Examples of this category are the telecommunications and automobile industries. For this category of SOEs, the government can adopt a “market for capital” approach to get access to capital from international markets and remove the adverse impact of the domestic endowment structure on these firms’ viability. There are two ways to achieve this goal: one is to encourage SOEs to go public on international equity markets; the second is to set up joint ventures with foreign companies and get direct access to foreign technologies and capital. China Mobile, China Telecom, and China Petroleum have followed the first approach and many automobile makers in China have followed the joint-venture approach. The third category of SOEs has limited domestic markets for their products and thus this group of SOEs cannot adopt the “market for capital” approach. The way for them to solve the viability issue is to make use of their engineering and managerial capacities and to shift their production to labor-intensive products, which have large domestic markets and at the same time are consistent with China’s comparative advantages. The most famous example of a firm following this approach is the color TV maker, Changhong. This firm used to produce old-style military radar. After switching to the production of color TVs, the firm has dominated the Chinese market and is very competitive in international market. Most SOEs have advantages in engineering and managerial personnel. If they are given the opportunity to shift their production lines to labor-intensive products, many of them can become viable. The fourth group consists of nonviable firms that lack engineering capacity and are thus unable to shift their production to new markets. These SOEs should be allowed to go bankrupt.

After the viability problem of the existing firms is solved, whether or not a firm can earn acceptable profits in an open, competitive market becomes the responsibility of the firm’s managers. The performance of a firm will depend on the corporate governance, incentive mechanisms, and other factors, as identified in neoclassical economics. The government will no longer be responsible for a firm’s performance. Only then can the reform of institutions that are inherited from the traditional central planning system with the functions of subsidizing and protecting SOEs be carried out thoroughly and the transition from a planned economy to a market economy completed.

V. Concluding Remarks

In this paper, I review the Washington Consensus as a transition approach in former socialist economies and other developing countries from the new structural economics perspective. Economic development, which reflects the ever-increasing average labor productivity and per capita income, is a process of continuous structural changes in technologies, industries and hard and soft infrastructure.The difference in economic structure for countries at different levels of economic development is a result of the differences in their endowment structure. Firms in an industry will be viable in an open, competitive market only if the industry is consistent with the comparative advantage determined by the economy’s endowment structure. Many firms in transition economies and developing countries were not viable because, due to their governments’ ambitious development strategies, these firms were in industries against their economies’ comparative advantages.Their survival required the governments’ subsidies and protections through price distortions, limitations on market competition,and administrative allocation of all kinds of resources. The results of these interventions were inadequate competition, lack of effective corporate governance, rent seeking, disparities in income distribution, inefficient resource allocation, and, quite possibly, economic crisis. The Washington Consensus, which did not pay sufficient attention to the endogeneity of those distortions, advised the governments to focus the reforms on strengthening property rights, improving corporate governance, removing government intervention in resource allocations, and so on, to improve the efficiency of the market. When a majority of the firms in an economy were nonviable, the implementation of these transition policies led to an awkward situation of shock without therapy, as in the FSUEE and the lost decades in other developing countries (Easterly, 2001; Lin and Liu 2004).

Since many firms in plan economies, transition economies, and developing economies are not viable it is essential to relax the implicit viability assumption in the existing neoclassical economics when applying the neoclassical approach to study the problems in those economies.The relaxation of viability assumption will enrich the neoclassical economics and help to redefine the role of government in economic transition and development.The government needs to be pragmatic in designing its transition strategy when a large number of firms in the economy are nonviable in an open, competitive market. The government should also play an enabling role in a market economy to facilitate the industrial upgrading accordingly to the change in the country’s comparative advantage by helping individual firms overcome inherent externality and coordination issues in the development process (Lin 2009, 2011).

After more than two decades of transition from plan to market in FSUEE and China, some economists may call an end to transition economics as a subfield in modern economics (Sonin 2013). However, many nonviable firms and structural problems still exist in the transition economies(EBRD 2013)and more importantly structural transformation and transition area permanent feature of modern economic development, there is a need for a new transition economics (Pistor 2013). The new structural economics provides an analytical foundation for the new transition economics.

Acemoglu, D., Johnson, S. and Robinson, J. A. (2001). ‘The Colonial Origins of Comparative Development: An Empirical Investigation’.American Economic Review, 91, 1369–401.

Acemoglu, D., Johnson, S. and Robinson, J. A. (2002). ‘Reversal of Fortune: Geography and Institutions in the Making of the Modern World Income Distribution’.Quarterly Journal of Economics, 117, 1231–94.

Acemoglu,D., Johnson, S. and Robinson, J. A. (2005). ‘Institutions as the Fundamental Cause of Long-Run Growth’. In P. Aghion and S. N. Durlauf (eds),Handbook of Economic Growth.Volume 1, Part A. Amsterdam: Elsevier Science Publishers (North-Holland), 385–472.

Balcerowicz, Leszek (1994). Common Fallacies in the Debate on the Transition to a Market Economy,Economic Policy. 9:16-50.

Blanchard O., R. Dornbusch, , P. Krugman, , R. Layard, and L. Summers (1991).Reform in Eastern Europe. Cambridge (Mass.): MIT Press.

Boycko, Maxim, Andrei Shleifer and Robert Vishny (1995).Privatizing Russia. Cambridge (Mass.): MIT Press.

Barro, R. J. (1998).Determinants of Economic Growth: A Cross Country Empirical Study. Cambridge, Mass.: MIT Press.

Brada, J. C. (1996). ‘Privatization Is Transition, Or Is It?’.Journal of Economic Perspectives, 10, (2), 67–86.

Brada, Josef C., and Arthur E. King (1991). Sequencing Measures for the Transformation of Socialist Economies to Capitalism: Is There a J-Curve for Economic Reform?Research Paper Series# 13, Washington, D.C.: Socialist Economies Reform Unit, World Bank.

Campos,Nauro. F. and Fabrizio Coricelli (2002). Growth in Transition:WhatWe Know, What We Don’t, and What We Should,Journal of Economic Literature, 40 (3): 793-836.

Dabrowski, Marek (2001). Ten Years of Polish Economic Transition, 1989-1999, in: Mario I. Blejer and Marko Skreb (eds.),Transition: The First Decade. Cambridge (Mass.): MIT Press: 121-152.

de Soto, H. (1987).The Other Path. New York: Harper & Row.

Dell’Anno, R. andS.Villa, (2013).‘Growth in Transition Countries: Big Bang versus Gradualism,’Economics o Transitio, 21 (3): 381-417.

Dewatripont, M. and Maskin, E. (1995). ‘Credit and Efficiency in Centralized and Decentralized Economies’.Review of Economic Studies, 62, (4), 541–56.

Dewatripont, M. and Roland, G. (1992a).“The Virtures of Gradualism and Legitimacy in the Transitio to Market Economy,”The Economic Journal,102(March), 291-300.

Dewatripont, M. and Roland, G. (1992b).“Economic Reform and Dynamic Political Constraints,”Review of Economic Studies, 59 (4), 703-30.

Dewatripont, M. and Roland, G. (1995).“The Design of Reform Packages under Uncertainty,”American Economic Review,85 (5), 1207-27.

Easterly, William, (2001). The Lost Decades: Developing Countries’ Stagnation in Spite of Policy Reform 1980-1998,Journal of Economic Growth.6: 135-57.

Engerman, S. L. and Sokoloff, K. L. (1997). ‘Factor Endowments, Institutions, and Differential Paths of Growth among New World Economies: A View from Economic Historians of the United States’. In S. Haber (ed.),How Latin America Fell Behind, Stanford: Stanford University Press, 260-304.

European Bank for Reconstruction and Development(EBRD)(2007).Life in Transition: A Survey of People’s Attitude and Experiences. London: European Bank for Reconstruction and Development.

European Bank for Reconstruction and Development(EBRD)(2013). Transition Report 2013, London: European Bank for Reconstruction and Development.

Frydman, R., Gary, C. W. and Rapaczynski, A. (eds) (1996).Corporate Governance in Central Europe and Russia, Volume 2: Insiders and the State. Budapest: Central European University Press.

Galbraith, James K. (2002).Shock without Therapy,The American Prospect(online).13: 2002 .

Grossman,G. M. and Helpman, E.(1996),‘Electoral Competition and Special Interest Politics’,The Review of Economic Studies, 63,(2),265-286.

Grossman, G. M. and Helpman, E. (2001).Special Interest Politics. Cambridge and London: MIT Press.

Groves, T., Hong, Y., McMillan, J. and Naughton, B. (1994). ‘Autonomy and Incentives in Chinese State Enterprises’.Quarterly Journal of Economics, 109, (1), 183–209.

Harrold, Peter (1992). China's Reform Experience to Date,World Bank Discussion Paper, 180 . Washington, D.C.: the World Bank.

Jefferson, G. and Rawski, T. (1995). ‘How Industrial Reform Worked in China: The Role of Innovation, Competition, and Property Rights’.Proceedings of the World Bank Annual Conference on Development Economics 1994, Washington, DC: World Bank, 129–56.

Kolodko, Grzegorz W. (2000).From Shock to Therapy: The Political Economy of Post-socialist Transformation. Helsinki, Finland: UNU/WIDERStudies in Development Economics.

Kornai, Janos (1986). The Soft Budget Constraint,Kyklos. 39: 3-30.

Kornai, Janos (1990).The Road to a Free Economy.New York: Norton.

Kornai, Janos (2006).‘The Great Transformatio of Central Eastern Europ: Success and Disappointment,”Economics of Transition, 14 (2): 207-244.

Krueger, Ann O. (1974). The Political Economy of the Rent-seeking Society,American Economic Review. 64: 291-303.

Krugman, P. (1981). ‘Trade, Accumulation and Uneven Development’.Journal of Development Economics,8, (2), 149–61.

Krugman, P. (1987). ‘The Narrow Moving Band, the Dutch Disease, and the Competitive Consequences of Mrs Thatcher’.Journal of Development Economics,27, (1/2), 41–55.

Krugman, P. (1991). ‘History versus Expectations’.Quarterly Journal of Economics,106, (2), 651–67.

Jefferson, G., Rawski, T. (1995). How Industrial Reform Worked in China: The Role of Innovation, Competition, and Property Rights,Proceedings of the World Bank Annual Conference on Development Economics 1994. Washington, D.C.: World Bank: 129-56.

Lal. D. and Myint, H. (1996).The Political Economy of Poverty, Equity and Growth: A Comparative Study. Oxford: Clarendon Press.

Lavigne, Marie (1995).The Economics of Transition: From Socialist Economy to Market Economy. New York: St. Martin’s Press.

Lau,L., Qian, Y. and Roland, G. (2000),Reform without losers : an interpretation of China's dual-track approach to transition,Journal of Political Economy,108(1):120-143.

Li, D. D. (1996). ‘A Theory of Ambiguous Property Rights in Transition Economies: The Case of the Chinese Non-state Sector’.Journal of Comparative Economics, 23, (1), 1–19.

Li, W. (1997). ‘The Impact of Economic Reform on the Performance of Chinese State Enterprises, 1980–89’.Journal of Political Economy, 105, (5), 1080–106.

Lin, Justin Yifu (1992). Rural Reforms and Agricultural Growth in China,American Economic Review. 82: 34-51.

Justin Yifu Lin (2003). Development Strategy, Viability and Economic Convergence,Economic Development and Cultural Change.53: 277-308.

Lin, Justin Yifu (2011),“New Structural Economics: A Framework for Rethinking Development,”the World Bank Economic Researech Observer,Vol. 26, No.2: 193-221.

Lin, Justin Yifu (2012a),New Structural Economics: A Framework for Rethinking Development and Policy, Washington, DC: World Bank.

Lin, Justin Yifu (2012b),Demystifying the Chinese Economy,Cambridge: Cambridge University Press.

Lin, Justin Yifu (2009),Economic Development and Transition, Cambridge: Cambridge University Press.

Lin, J.Y. and Chen, B.K. (2007).‘Development Strategy, Financial Repression and Inequality’. China Center for Economic Research, Peking University (manuscript).

LiLin, J.Y. and Li, Z.Y. (2008).‘Policy Burden,Privatisationand Soft Budget Constraint’,Journal of Comparative Economics.36: 90-102,.

Lin, J. Y. and Liu, P. L.(2008). ‘Promoting Harmonious Development by Achieving Equity and EfficiencySimultaneously in the Primary DistributionStage in the People’s Republic of China’.Asi