Research﹀

-

Latest Activities NSE International Conference NSE Symposium/Winter Camp

-

Objectives and Actions Working Groups Database Reports & Publications Governance and Partners Events Policy Briefing

Why can National Development Banks Provide Long-Term Finance?

2022-10-31

Why can National Development Banks Provide Long-Term Finance?

——Answers from the First Applied Theoretical Paper

Alfredo Schclarek, Jiajun Xu* , Jianye Yan

The present op-ed is based on the following open-source journal article:

Schclarek, Alfredo, Xu, Jiajun* , & Yan, Jianye. (2022). The Maturity-Lengthening Role of National Development Banks. International Review of Finance, 1–28. https://doi.org/10.1111/irfi.12391.

* Corresponding author: Jiajun Xu

Affiliation: Institute of New Structural Economics, National School of Development, Peking University

Address: Langrun Garden 165, Yiheyuan Road No. 5, Peking University, Beijing, P.R. China, 100871

E-mail: jiajunxu@nsd.pku.edu.cn.

Long-term finance plays a pivotal role in promoting long-term economic growth and financial stability. However, long-term finance is often in short supply in a laissez-faire decentralized banking system with commercial banks only. One key way for governments to overcome the scarcity of long-term finance is to establish national development banks (NDBs) with the official mission of providing long-term capital to fill the market gaps.

Based on the first global database on public development banks and development financing institutions worldwide developed by the Institute of New Structural Economics at Peking University in collaboration with the French Development Agency, Hu, Schclarek, Xu, and Yan (2022) find that NDBs on average lend longer than commercial banks after controlling for bank-level and country-level factors. Yet little is known what enables NDBs to lend longer than commercial banks. Our paper aims to fill the gap by theoretically examining the question of under what conditions NDBs can provide longer-term loans than commercial banks.

I. Why is it difficult for Commercial Banks to Provide Long-Term Finance?

In a banking system with private commercial banks (PCBs) only, PCBs optimally choose the maturity of their lending to firms. PCBs grant loans by creating bank deposits that firms will use to make payments at any time. This does not imply that PCBs can create bank deposits without limit. One key constraint is the liquidity risk. In case of liquidity risks, when a PCB does not have sufficient liquid assets, it has to issue bonds or equivalently obtaining an interbank loan to settle its payments with another PCB on behalf of its borrowers to overcome the survival constraint.

The maximum amount that the PCB can obtain by issuing bonds determines whether it can solve the liquidity problem. As this maximum amount of borrowing is primarily determined by the collateral capacity of the PCB’s assets (or loans to firms), we call it as the collateral value of the bonds. The higher the collateral value of the PCB bonds is, the longer-term the PCB can lend to firms.

Yet other PCBs may not be willing to grant loans or purchase bonds issued by the PCB that suffers from the liquidity problem, if they judge that the quality of the PCB’s assets is not good, and its owner lacks the capacity and willingness to recapitalize it in case of defaults. If this is the case, the PCB would choose to grant short-term loans to firms to mitigate potential liquidity problems. In a nutshell, the optimal maturity of loans provided by PCBs is largely determined by the recapitalization capacity and willingness of their owners.

In short, long-term finance is often in short supply in a banking system with PCBs only.

II. State Ownership Matters

To ensure the provision of long-term finance, governments establish state-owned national development banks (NDBs) to fill the gap. Unlike deposit-taking PCBs, NDBs issue bonds purchased by PCBs to fund their operations. Hence, NDBs do not participate in the retail payment system. In other words, firms that receive NDB loans would operate their payments through PCBs. In the banking system with an NDB and PCBs, in case that PCBs need to settle interbank payments to mitigate liquidity risks, they may sell the NDB bonds instead of issuing their own bonds or, equivalently, requesting an interbank loan.

NDBs can lend longer than PCBs, because the collateral value of NDB bonds is higher than that of PCB bonds. The reason why NDB bonds enjoy the higher collateral value is that the governments, the owner of the NDB, has greater recapitalization capacity and willingness than owners of PCBs.

The greater recapitalization capacity of the government hinges not only on the size of the government in comparison with the private bank owners in terms of owning liquid assets, but also fundamentally on the ability to raise taxes given by the legal power of the state. In addition, the government may find it easier and cheaper than private bank owners to access additional capital by borrowing from national or international financial markets. Yet it is worth noting that this argument about the higher recapitalization capacity of the government depends on the assumption that the fiscal stance of the government is strong and sustainable. Thus, it is key that the government has a strong and sustainable fiscal stance for a successful recapitalization.

The government is more willing to recapitalize NDBs than private bank owners are to recapitalize their PCBs. The government may be more eager to recapitalize the NDB to foster and preserve state capacities, such as in-house financial and industrial expertise, that would be lost in case of default and the closure of the NDB. Even though in practice the government has even been willing to bail out private banks to avoid their closure given that bank failures may have externalities by affecting other banks through contagion and the economy as a whole, it should be expected that private bank owners, creditors, and bondholders will suffer some losses even if the private banks are eventually recapitalized. This will undermine the collateral value of private bank bonds, given the probable losses of bondholders. Consequently, even if the government may be willing to bail out private banks, especially large, systemically important, and interconnected private banks, it is not unreasonable to expect that the willingness to bail out a state-owned bank is likely to be higher.

III. Double-Edged Sword of State Ownership

Even though the NDB has an advantage over PCBs given by the higher recapitalization capacity and willingness by the government over private bank owners, state ownership is double-edged sword if the government unduly intervenes in the NDB's operation undermining its monitoring quality. The poor governance of the NDB would negatively affect monitoring skills, such as the evaluation of projects, screening of borrowers, or even collection of repayments by borrowers. Low monitoring quality of the NDB would undermine the collateral capacity of their assets, hence diminishing the collateral value of NDB bonds.

In short, the undue government intervention would degrade the low monitoring quality of the NDB undermining the maturity-lengthening role of the NDB.

IV. Market Liquidity of Bonds Matters

If state ownership matters, what is the niche of the NDB compared with state-owned commercial banks (SOBs)? NDB bonds may have the higher collateral value than SOB bonds, if NDB bonds may enjoy the higher market liquidity. The higher market liquidity of bonds would enhance the collateral value of those bonds, because a bond with lower market liquidity will not only require a higher interest rate at issuance (the coupon rate), but also will be traded at a discount in the secondary market after having been issued.

One possible justification for the higher market liquidity of NDB bonds than SOB bonds is size matters. In the banking system with an NDB and commercial banks implies that only one type of bond will be issued, the NDB bonds, and that commercial banks will buy that bond. The size of the NDB bond issuance will be systemically large. Instead, the banking system with only commercial banks implies that many different bonds will be issued, one for each commercial bank that issues bonds in case of liquidity problems, and thus no individual bond issuance will be large enough. Thus, as the trading volume for NDB bonds is greater than that of any individual commercial banks, NDB bonds will have a higher market liquidity than commercial bank bonds.

Another justification for the higher market liquidity of NDB bonds is that NDB bonds enjoy lower participation costs (e.g., to monitor market movements and information) to be ready to trade in the secondary bond market. As the NDB that finances its lending by issuing NDB bonds that are bought by commercial banks in the initial period of disbursing loans, those commercial banks that face a net deposit inflow in the intermediate period when liquidity problems occur are more likely to accept NDB bonds to settle payments because these commercial banks are already correctly informed for the trade and do not need to incur additional participation costs in case of liquidity problems.

In short, even though both the NDB and SCBs are state-owned, the NDB may have an advantage over SCBs in the provision of long-term finance if NDB bonds enjoy the higher market liquidity.

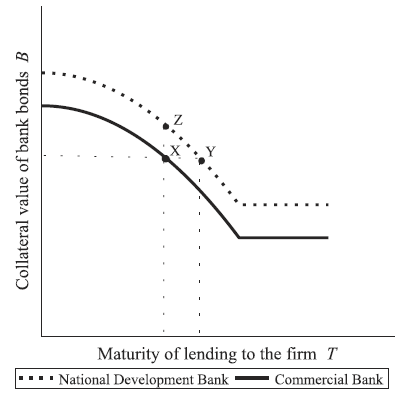

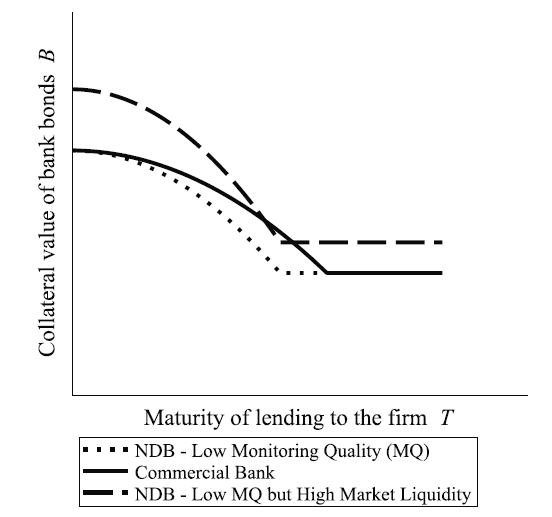

Coming back to the core research question of what enables NDBs to lend longer than commercial banks, Figures 1 and 2 below summarize the key insights. Figure 1 shows that owing to the greater recapitalization capacity and willingness of the government than that of private bank owners, NDB bonds enjoy the higher collateral value enabling the NDB to lend longer than PCBs. Figure 2 shows that low monitoring quality would diminish the advantage of the NDB over commercial banks, but higher market liquidity enables the NDB to lend with longer maturities in comparison with commercial banks.

Figure 1 Collateral Value of Bank Bonds and the Maturity of Lending to Firms

Figure 2 The Impact of Monitoring Quality and Market Liquidity upon the Collateral Value of Bank Bonds

V. Policy Implications

To unleash the potential of NDBs for providing the long-term finance, we have drawn the following policy implications:

First, NDBs should be well capitalized to unleash their potential for scaling up the provision of long-term finance. This policy recommendation is particularly relevant given the trend that NDBs are undergoing a renaissance worldwide. Even if NDBs have comparative advantages in providing long-term finance, their contribution to filling the financing gap would be substantially undercut if they are undercapitalized. Hence, the maturity-lengthening role of NDBs is more relevant for countries that have governments with stronger credibility, finances, and net worth than for countries with governments plagued by credibility concerns, over-indebtedness, and excessive fiscal deficits. For countries whose governments are in a relatively weak financial position, their NDBs should try to seek on-lending (see Schclarek and Xu, 2022) from multilateral development banks or NDBs from countries with a strong financial foothold.

Second, NDBs need to be well governed to unleash their potential for providing long-term finance. State ownership is a double-edged sword. Although governments should play a steering role in setting the corporate strategy of NDBs to ensure they proactively fulfill public policy objectives, governments should not unduly intervene into the microlevel loan approval or appraisal procedure of NDBs. Otherwise, undue government intervention would undermine the quality of assets, hence undercutting their ability of providing long-term finance. Therefore, governments should try to build the firewalls to guard NDBs against undue political influence and should ensure that NDBs enjoy a sufficient degree of professional autonomy to better implement their development-oriented mandates.

Finally, the maturity-lengthening role of NDBs is enhanced by the higher market liquidity of NDB bonds if NDBs are larger in terms of their relative bond issuance size in the banking system. Ensuring the higher market liquidity of NDB bonds is an important argument in favor of NDBs that follow a business model centered on financing themselves through bond issuance rather than trying to mimic commercial banks that are in the retail payment system and are deposit creators and takers.

The Maturity-Lengthening Role of National Development Banks

开源论文,欢迎转载!

Be free to circulate the above open-source paper!