Research﹀

-

Latest Activities NSE International Conference NSE Symposium/Winter Camp

-

Objectives and Actions Working Groups Database Reports & Publications Governance and Partners Events Policy Briefing

Jianjun Miao: Convergence and Financial Development

2019-01-08

Content introduction:

Keynote Speech

Background

The industrial revolution marked a dramatic turning point in the economic progress of nations. During the nineteenth century, a number of technological leaders in the Western Europe and North America leapt ahead of the rest of the world, while others lagged behind and became colonies or semi-colonies of the Western powers. After the WWII, most developing countries obtained political independence and started their industrialization and modernization process. One might expect that, with the spread of technology and the advantage of backwardness (Gerschenkron (1962)), the world should have witnessed convergence in income and living standard. Instead, the post WWII was a period of continued and accelerated divergence (Pritchett (1997)). According to Maddison (2008), the per capita GDP of the U.S., the most advanced countries in the 20th century, grew at an averageannual rate of 2.1% between 1950 and 2008. While some OECD and East Asian economies were able to narrow the per capita GDP gap with an annual growth rate higher than that of the U.S. in the catch up process, most other countries in Latin America, Asia, and Africa failed to achieve so.

Why some countries fail to converge in growth rates despite the possibility of technology transfer has been a puzzle.

Analyzing& Questions

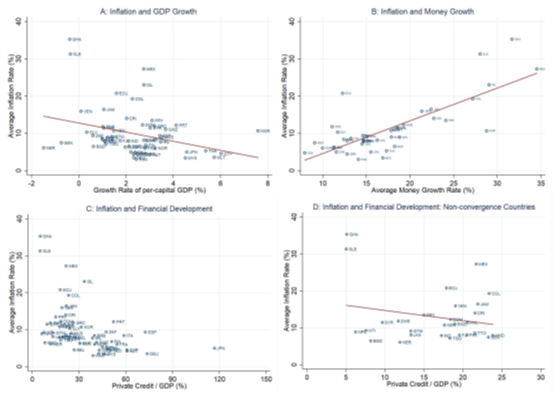

The researchers analyze the relationship among growth, inflation, and financial development. Figure 1 presents the cross-sectional evidence on a sample of 71 countries over the period 1960-1995. Panels A and B show that the average inflation rate is negatively correlated with the average per capita GDP growth rate and positively correlated with the average money growth rate. Panel C shows that the average inflation rate is negatively correlated with the average level of financial development and this relationship vanishes at a high level of financial development (about 50%). Panel D displays the countries that fail to converge to the world frontier growth rate, identified byAttribute Hierachical Model (AHM) (2005). These countries have a low average level of financial development and their inflation is negatively correlated with the average levelof financial development.

Figure 1

The questions are: Firstly, how does inflation move at different development stages? Secondly, what is an efficient allocation when there is a utilitarian social planner? Thirdly, what kind of monetary and social policies can make a market economyattain an efficient allocation?

Model

Motivated by all above, the researchers introduce a monetary authority and a government to a closed-economy version of the AHM model. The researchers modify this model in several ways. First, the researchers introduce money by assuming money enters utility (Sidrauski(1967)). This money-in-the-utility approach can be micro founded in several ways once one takes into account the role of medium of exchange (McCallum (1983)). Although money can be valued in the OLG model as a store of value (Samuelson(1958)), the equilibrium net nominal interest rate is zero and hence one cannot analyze monetary policy in terms of interest rate rules. The modeling of money avoids this issue. Second, the researchers introduce intra-generational heterogeneity so that there are savers and borrowers (entrepreneurs) in each period. They can then endogenize the nominal interest rate in a credit market and study how credit market imperfections affect interest rates. Third, the researchers assume savers are risk averse. In each period a young saver must choose optimal consumption, money holdings, and saving in terms of nominal bonds.

Morespecifically: 1. Two-period OLG; 2. Each generation has a unit measure of identical entrepreneurs and a unit measure of identical savers; 3. Only entrepreneurs can conduct innovation, but they face borrowing constraints; 4. Innovators use world frontier technology; 5. Savers lend funds to entrepreneurs, but they cannot innovate.

Conclusion

The market equilibrium in the model can be summarized by a system of four nonlinear difference equations for four sequences of variables: the nominal interest rate, the inflation rate, the normalized R&D investment, and the proximity to the technological frontier. For this equilibrium system, monetary policy is modeled by a money supply rule. If one uses an interest rate rule as in the dynamic new Keynesian literature (Woodford (2003)), then money supply is endogenous and the nominal interestrate is replaced by the money growth rate in the equilibrium system.

It turns out that how money supply is introduced to the economy is critical for how money affects the equilibrium allocation and long-run growth. First, if money increments are transferred to the old agents in an amount proportional to their pre-transfer money holdings, then money is super-neutral. The intuition is that the demand for money and saving depends on the ratio of the nominal interest rate and the money growth rate and hence the real interest rate in the long run.

There are three dynamic patterns as in the AHM model with the difference that our model incorporates inflation:

1. When the credit market is perfect so that the credit constraint does not bind, the economy converges to the world frontier growth rate and there is no marginal effect of financial development;

2. When the credit constraint binds, but is not tight enough, the economy converges to the world frontier growth rate with a level effect of financial development.

3. When the credit constraint is sufficiently tight, there is a divergence in growth rates with a growth effect of financial development. In this case the economy enters equilibrium with poverty trap.

As for efficient allocation, suppose that there is a social planner who maximizes the sum of discounted utilities of allagents in the present and future generations. The researchers derive the efficient allocation and long-run growth rate. By comparing with the efficient allocation, the researchers find that there are four sources of inefficiency in market equilibrium. First, there is monopoly inefficiency in the production of intermediate goods. Second, the private return to innovation ignores the dynamic externality or spillover effect of technology. Third, the credit market imperfection prevents innovators to obtain necessary funds for R&D. Finally, the OLG framework itself may cause dynamic inefficiency.

Can a combination of monetary and fiscal policies correct the preceding inefficiencies and make the market equilibrium attain the efficient allocation? When money increments are transferred to the entrepreneur, money is not super-neutral and there is a particular nominal interest rate such that the market equilibrium can achieve innovation efficiency, but it cannot achieve output and consumption efficiency. The intuition is that money growth is like an inflation tax and there is a wealth effect when the tax is not proportionally distributed to the agents according to their pre-transfer money holdings. Money affects the real economy through the redistribution channel. As for fiscal policies, different policies are needed in different development stages. When the economy faces severe credit market imperfections, the government should try to loosen credit constraints by ensuring better contract enforcements or better monitoring of borrowers. For example, the government can make direct lending to entrepreneurs financed by lump-sum taxes on savers. When the government has better monitoring technologies than private agents, the credit constraints can be overcome. The economy can then avoid the equilibrium with poverty traps.

Written by: Wei JIN

Proofread by: Bo HU