Professors' Insights﹀

[Project Syndicate] Justin Yifu Lin: China’s Chance to Lead on Development

2016-08-10

China’s Chance to Lead on Development

JustinYifuLin

AUG 4, 2016,Project Syndicate

BEIJING – In September, China will host the G20 meeting of world leaders for the first time. It could not have chosen a more opportune moment to assume a leadership role. Chinese President Xi Jinping should seize the occasion to push China’s ambitious development agenda globally. Specifically, Xi should make the case that development done right benefits everyone, and he should launch discussions on a multilateral investment agreement to be developed in the next year.

This is an achievable goal for the summit: the G20 has a record of relative success in coordinating multilateral efforts, such as in its response to the 2008 global financial crisis. Moreover, the ingredients of successful development are very well known. They include constant technological improvement, which is critical for sustained growth and employment; a focus on maximizing human and physical capital; and infrastructure investments geared toward reducing transaction costs and increasing efficiency.

We also know the current gaps that exist in development. Developing countries today are constrained by low levels of human and financial capital, and by low reserves of or access to foreign exchange, which limits their ability to import the raw materials and equipment needed to ascend global value chains.

The best way to close the gaps in human and financial capital, and to increase access to foreign exchange, is through foreign direct investment. FDI should not be difficult to attract, because the potential returns should be higher in developing countries, where capital is scarce relative to labor.

But as Nobel laureate Robert Lucas noted , capital has been flowing in the wrong direction, from low- to high-income countries. This trend is depleting developing countries’ available capital, limiting development, and widening the global income gap.

As Laura Alfaro,SebnemKalemli-Ozcan, andVadymVolosovychpointed out in a 2008 study for theReview of Economics and Statistics, poorer countries are deprived of capital flows partly because they lack the institutions that are needed to receive and facilitate investments. In a sense, these countries are trapped, because they need capital to develop these necessary institutions in the first place.

A multilateral investment agreement could fix this problem by making it easier to invest in developing countries. It could also strengthen the economic foundation for growth in developing countries by establishing investment protections and incentives, dispute-resolution procedures, corporate social responsibility benchmarks, and regulatory frameworks for investments made by state-owned enterprises and sovereign funds.

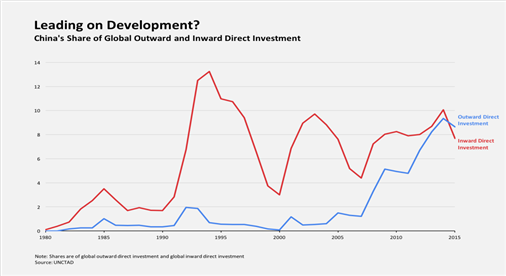

The World Trade Organization (WTO) is the natural place to negotiate this agreement, but past efforts have failed partly because negotiations were seen as heavily favoring developed countries over developing ones. With the global investment environment having changed dramatically in the past decade, negotiations should be restarted. As the figure below shows, developing countries now account for a growing share of global outward direct investment (ODI). This means that some emerging market economies themselves are becoming a source of capital and thus have a role to play in any future investment framework.

China is the prime example. As the following graph shows, China has benefited so much from FDI that it is now increasing its own ODI.

According to the UN Conference on Trade and Development , in 2013 China became the third largest source of other countries’ FDI and is expected to become a net capital exporter for the first time in 2016. This trend can only continue, considering the combined impact of China’s “Go Out Policy” of prodding domestic companies to make investments abroad, and it’s “One Belt, One Road” framework to build continent-wide trade infrastructure.

In time, China will likely be the world’s largest source of FDI. Having gone from being a recipient of FDI to a net contributor in recent decades, China is perfectly positioned to lead G20 discussions on global development.

It should do so by setting a concrete goal for a workable development framework with a clear timeline for reaching specific milestones. An early milestone should be to establish a non-binding investment facilitation framework for developing countries. And, more generally, the agreement should emphasize inclusiveness and honest dealing to foster economic growth for developing and developed countries alike.

JustinYifuLin, a former chief economist and senior vice president at the World Bank, is Professor and Honorary Dean of the National School of Development, Peking University, and the founding director of the China Center for Economic Research. He is the author, most recently, of Against the Consensus: Reflections on the Great Recession.